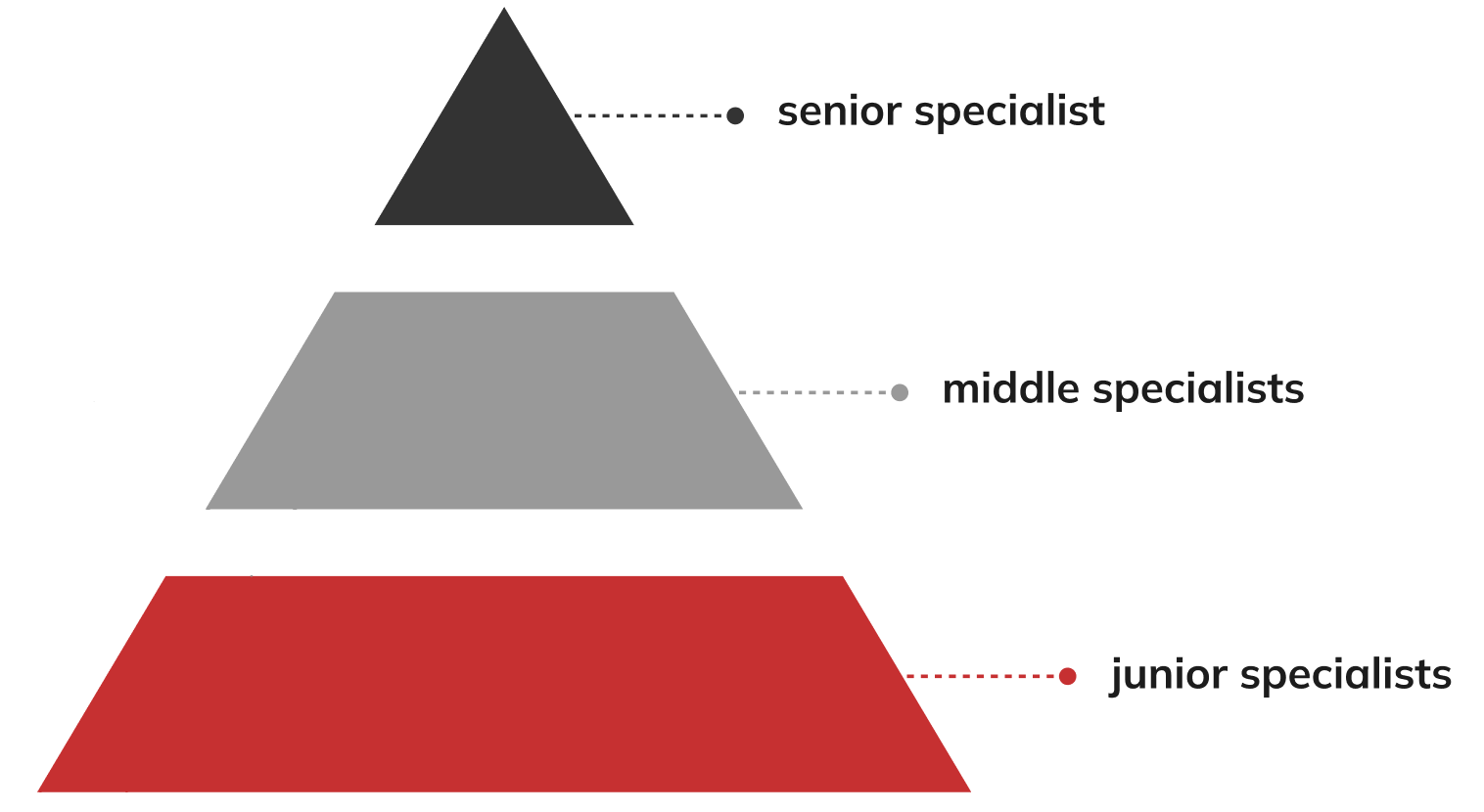

There was already an ongoing shortage of skilled labor in civil air transport even before the Covid contraction. However, during the Covid precautions period, the sector lost many retired and near-retirement trained, experienced personnel who did a lot of work with little input. The gap, which was previously concentrated at the bottom of the experience pyramid, has grown to spread to all layers with the Covid crisis.

New aircraft deliveries continue, while old planes’ lease agreements are kept being extended due to the delays. Vacuum on the operators’ side is already higher than MROs so the real bottle neck appears in base maintenance now. Even simple jobs get longer than usual. We will start to accept 2 x times longer base maintenance TATs as normal. Sacrifice of job quality for coping with the pace is the biggest concern. Authorizing not-sufficiently trained ones is the next one. Mismanagement of maintenance projects, and supply shortage will contribute to the extending maintenance TATs. Difficult days await us at all the aspects of the industry.

Operators

Operators are just reaching their pre-COVID-19 crisis operation levels. The recovery is not yet complete, but the challenges have largely been overcome. Although maintenance costs are lower, especially compared to fuel and flight crew expenses, they are among the expense items that are not preferred to increase. While it does not directly contribute to the turnover, the direct cut it creates in the turnover is sufficient reason alone to gain the antipathy of the board of directors. In this area, cost increases, especially those that are reflected in the tickets, are a big problem. In order not to lose their competitiveness in the market, managements resist increasing the average salary above a certain level, as if they cooperated.

Since the qualified workforce could not find the necessary support from the labor unions, it started to produce its own solution. The experienced workforce who cannot find the salary and working conditions they are looking for in airlines continues to shift to labor provider 3rd party companies. It seems that operators will no longer be able to go beyond serving as an intermediate stop with a capped salary. This model is more attractive for those who prefer job guarantee, social rights, and a relatively comfortable working environment to earnings. Unfortunately, the victim in this balance is productivity.

Labor Providers

The experienced workforce who shifts to labor provider 3rd party companies has the power to impose demands on the workforce and bargain just like a union. Also, they can set (frankly speaking enforce) the price they want in the free market.

Although this model meets their expectations in terms of earnings, they have difficulty because they are accustomed to working with salaries and certain guarantees under the roof of relatively well-established companies. Since the productivity expected from them is much higher than in the old system, they do not have as comfortable a working environment as before. Moreover, the decency and tradition of being a team and acting with team spirit is disappearing. The mentality of “I’ll work for whoever pays me” isolates employees within organizations.

Even though it is a model that causes constant blood loss for its own permanent staff, it is an attractive model to manage growth and shrink periods. They can easily manage the process by making a new contract or canceling the existing one.

They are in a position where they must stand completely on their own feet, compared to permanent employees who can protect their jobs with government support during the market’s downturn.

MROs

Those with aviation experience know the difference between an operator technician and an MRO technician. A technician trained in MRO will have a hard time due to the operational pressure when he moves to the airline. Likewise, a technician trained as an operator finds MROs too cumbersome and heavy. It is not right to make a comparison, but in terms of workforce compatibility, their interconnectivity is not very attractive. Therefore, it is not correct to talk about a one-to-one transition or change between the two areas. Therefore, both parties need to train and renew their own workforce.

Many aircraft parked during the Covid period cannot return to operation due to lack of maintenance slots in the hangars. In other words, the constraint in this area has directly affected operational capacity. This situation alone proves to what extent the man-hour deficit can affect the industry.

Technical Consultants

Some of the experienced personnel who became unemployed, especially after the Covid-19 crisis, started working as technical consultants. The additional workforce added to the market, which had shrunk considerably with the fleets on the ground, increased the competition among consultants. There was downward price pressure. No inflation adjustment was made.

Today, the tide has changed direction. Those who cannot find what they are looking for in an environment of tight competition and excess supply continue to return to permanent positions in the revived sector. The need for those with serious experience who continue their careers as technical consultants is greater than ever.

The biggest reason for this is that a well-trained and qualified technical consultant can prevent many delays by following the processes well, intervene in time for possible errors and show flexibility to support the shortages, which puts him in the position of an emergency service personnel. The fee paid to a good consultant is a guarantee of multiplied savings.

Ground Handling Companies

Ground handling services are perhaps the segment of the industry whose voice is least heard, but whose value is understood in their absence. All operations, except for the plane cutting its wheels at takeoff and touching the runway for landing, are carried out thanks to ground services. Covid-related workforce loss was much higher in this area. Since it was not considered a sector that required special training or specialization, all employees who achieved better conditions changed sectors irreversibly. This blood loss paved the way for improving the conditions of existing employees and evaluating them more precisely. The man-hour shortage in other parts also manifests itself in this area as inadequate ground equipment, delayed service, and rising fees.

Manufacturers

Although they are perhaps the most free and innovative segment of the industry, they are restricted in many points due to the adaptation problem that the rest of the industry will experience. New generation systems do not lack efficient solutions, but they are reluctant to implement them either because the sector is not ready or because of possible conflicts with the authority. This approach traps the sector in a cycle that constantly repeats itself. Recently, criticism of the design and production quality, especially regarding the Boeing 737 Max aircraft and A320NEO engines, has made all manufacturers much more sensitive. They are almost forced to make choices based on existing systems that are more distant from innovations and competition.

Although we all know that new systems always bring unforeseen pains, issues that create commercial consequences turn into opportunities that competitors use to increase market share. Since lost market share is the biggest nightmare of companies, new designs turn into a self-destructive renewal deadlock. When these innovations are made specifically to reduce prices, they can turn into commercial suicide, as in the Max example.

Suppliers

Increasing new aircraft production on the one hand, and ever-increasing second-hand market on the other hand, the suppliers took their share while trying to keep up with the demand from this sudden expansion. Companies engaged in second-hand parts sales and aircraft dismantling are experiencing one of their most productive periods. On the one hand, aircraft that are decided to be part-out because it is not economical to return them to operation create an abundance of spare parts, on the other hand, rising demand due to increased capacity causes business volumes to increase significantly. Since the need for experienced personnel is high in this field of the industry, it draws workforce from airlines and MROs during the growth process, causing the current deficit to widen.

Authorities

Of course, it is the authorities who have their share of all the difficulties we have listed. They are still a long way away from new and risky business models, aware that they will ultimately be held responsible for any crisis. While they should be leading the industry, they are inadequate in terms of supervision because they mostly follow it from behind.

Authority employees, who are already suffering from lagging wages, have fallen further behind with the rising market. In this environment, it is not possible for any authority to retain a qualified workforce. It is also impossible for authorities to compete with the private sector, as they are subject to the standard government worker salary category. It is guaranteed that old problems will continue in the short term. On the other hand, the ongoing inspection crisis on the Boeing Max aircraft has painfully shown that the labor shortage in this field cannot be underestimated. This situation may turn the tide for the authorities in the long run. Time will tell whether there will be a positive change.

Conclusion

It is not possible to produce quick and practical solutions to such a broad problem that affects every player in the industry. We must be prepared to experience bottlenecks in different areas for a while. It will not be that fast or easy to close the gaps opened or widened by the Covid-19 crisis in a very short time. Both management and employees will have to abandon their old habits. Everyone will benefit from the change.